A business-based valuation model, also known as full enterprise valuation, assesses the value of spectrum from a commercial perspective. The objective is to understand how much profit the spectrum in question will generate for a mobile operator over the licence duration. Estimating the value of spectrum involves the analysis of the impact on profits as a result of changes in spectrum fees over the modelling period. To derive the full enterprise value of spectrum, it is assumed that spectrum is a free input into the business.

A discounted cash flow (DCF) model is typically used and it involves two components:

- Revenue – total revenue estimated based on current and future demand (subscribers, ARPU), market circumstances (competition)

- Costs – network costs (radio access network, core network), non-network expenses (selling, general, administrative expenses, tax)

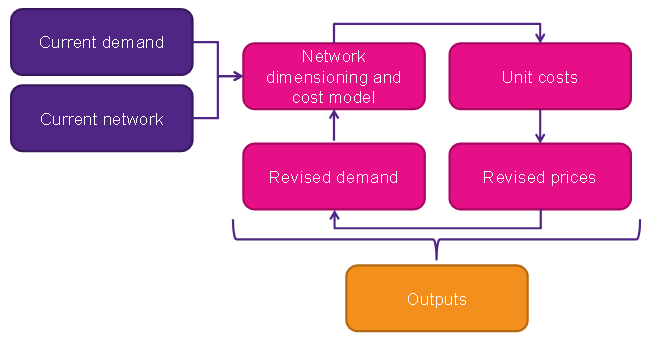

The figure below provides a simple illustration of the DCF modelling approach.

The net present value (NPV) of the profit stream for the operator is then calculated and this is attributed to the operator’s spectrum portfolio. The assumption is that all profits are derived from the use of spectrum although in practice part of this value will be derived from other intangible factors (such as brand and the company’s reputation to customers) which cannot be readily quantified. This NPV can be considered the full enterprise value of the spectrum and an upper bound on what the operator would be prepared to pay for the spectrum. A price higher than this level would mean the operator modelled would go out of business.